Web site for the film:

http://www.sonyclassics.com/insidejob/

"It's the War Department" Blog examines the corporate-Pentagon-Congressional-White House-Mainstream Media Complex that has produced militarism, empire, and permanent war costing trillions of dollars. Thus this post is relevant because our militarized economy deeply affects Wall Street, might be said to be Wall Street. Stiglitz and Bilmes' The Three Trillion Dollar War about invasion and occupation of Iraq shows some of this. Urgently needed are more research, books, films showing the connections just as thoroughly as Nicolas Davies in Blood on Our Hands demonstrates the war crimes of the US invasion and occupation of Iraq.

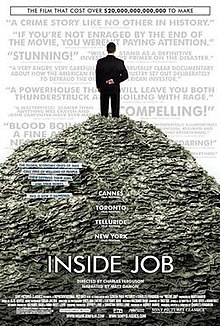

Inside Job (film)

From Wikipedia, the free encyclopedia

| Inside Job | |

|---|---|

| |

| Directed by | Charles Ferguson |

| Produced by | Audrey Marrs Charles Ferguson |

| Narrated by | Matt Damon |

| Music by | Alex Heffes |

| Cinematography | Svetlana Cvetko Kalyanee Mam |

| Editing by | Chad Beck Adam Bolt |

| Distributed by | Sony Pictures Classics |

| Release date(s) | May 16, 2010 (Cannes) October 8, 2010 (United States) |

| Running time | 1:48:49 minutes |

| Country | United States |

| Language | English |

| Budget | $2 million[1] |

Ferguson has described the film as being about "the systemic corruption of the United States by the financial services industry and the consequences of that systemic corruption."[3] In five parts the film explores how changes in the policy environment and banking practices helped create the 2008 financial crisis. Inside Job was well received by film critics who praised its pacing, research and explanation of complex material.

Contents[hide] |

[edit] Synopsis

The subject of Inside Job is the global financial crisis of 2008. It features research and extensive interviews with financiers, politicians, journalists, and academics. The film follows a narrative that is split into five parts.The film focuses on changes in the financial industry in the decade leading up to the crisis, the political movement toward deregulation, and how the development of complex trading such as the derivatives market allowed for large increases in risk taking that circumvented older regulations that were intended to control systemic risk. In describing the crisis as it unfolded, the film also looks at conflicts of interest in the financial sector, many of which it suggests are not properly disclosed. The film suggests that these conflicts of interest affected credit rating agencies as well as academics who receive funding as consultants but do not disclose this information in their academic writing, and that these conflicts played a role in obscuring and exacerbating the crisis.

A major theme is the pressure from the financial industry on the political process to avoid regulation, and the ways that it is exerted. One conflict discussed is the prevalence of the revolving door, whereby financial regulators can be hired within the financial sector upon leaving government and make millions.

Within the derivatives market, the film contends that the high risks that began with subprime lending were transferred from investors to other investors who, due to questionable rating practices, falsely believed that the investments were safe. Thus, lenders were pushed to sign up mortgages without regard to risk, or even favoring higher interest rate loans, since, once these mortgages were packaged together, the risk was disguised. According to the film, the resulting products would often have AAA ratings, equal to U.S. government bonds. The products could then be used even by investors such as retirement funds who are required to limit themselves to the safest investments.

Another issue discussed is the high pay in the financial industry, and how it has grown in recent decades out of proportion to the rest of the economy. Even at the banks that failed, the film shows how bank executives were making hundreds of millions of dollars in the period immediately up to the crisis, all of which was kept, again suggesting that the risk/benefit balance has been broken.

An issue that the film adopts which few others have addressed is the role of academia in the crisis. Ferguson notes, for example, that Harvard economist, and former head of the Council of Economic Advisers under President Reagan, Martin Feldstein, was a director of the insurance company AIG and former board member of the investment bank J.P. Morgan & Co.. Ferguson also notes that many of the leading professors and leading faculty members of the economics and business school establishments often derive large proportions of their incomes from either engaging as consultants, or speaking engagements. For example, current dean of the Columbia Business School, Glenn Hubbard received a large percentage of his annual income from either acting as a consultant or through speaking engagements. Hubbard was also affiliated with KKR and BlackRock Financial. Hubbard as well as current chair of Harvard's department of economics, John Y. Campbell, deny the existence of any conflict of interest between academia and the banking sector.

The film ends by contending that despite recent financial regulations, the underlying system has not changed; rather the remaining banks are only bigger, while all the incentives remain the same.

[edit] Production

It was produced by Audrey Marrs with Jeffrey Lurie and Christina Weiss Lurie as executive producers. The directors of photography were Svetlana Cvetko and Kalyanee Mam.Alex Heffes composed the music and Matt Damon narrated. The song Congratulations by MGMT is featured during the end credits.

[edit] Reception

The film has received very positive reviews, earning a 98% "fresh" rating on Rotten Tomatoes website, which compiles reviews from multiple critics.[4] One viewer-reporter characterized the film as "rip-snorting [and] indignant [with] support from interviews with Nouriel Roubini, Barney Frank, George Soros, Eliot Spitzer, Charles R. Morris and others. But the most effective presence," he continues, "may be the trusted voice of all-American actor Matt Damon, who narrates the furious takedown of the financial services and the government. It's a fairly bold move by the actor."[5]It was selected for a special screening at the 2010 Cannes Film Festival. A reviewer writing from Cannes characterized the film as telling "a complex story told exceedingly well and with a great deal of unalloyed anger. [It] lays out its essential argument, cogently and convincingly, that the 2008 meltdown was avoidable. Less familiar faces, including a brothel madam and a therapist who each catered to Wall Street in the bubble years are also seen, and the movie ends not long after Robert Gnaizda, formerly with the Greenlining Institute, a housing advocacy group, characterizes the Obama administration as 'a Wall Street government', a take Mr. Ferguson clearly endorses."[6]

Writing from proximity to an epicenter of a southwestern Florida region profoundly affected by the collapse, another reviewer, Dennis Maley, relates, "[h]aving followed and covered the related events closely, I cannot think of a more effective way to explain the sordid mess to a curious layman than having them watch this film. Ferguson has succeeded in taking a complex and sometimes dry topic and making it not only surprisingly digestible, but thoroughly entertaining." Maley notes the effectiveness of the director's approach, "...letting full-length answers speak for themselves, the punctuating silence at the end of the response reminding the viewer that no creative editing was needed..." and, summing it up as "... a gripping account of what happened, how it came to be and most frighteningly, why it will all happen again.[7]

The film has been criticised for not looking at the system of cartelised money production which allows for the financial misbehaviour, as the makers demand government controls over finance while their own film demonstrates that government is largely captured by private financial interests.

[edit] Awards

| Award | Date of ceremony | Category | Recipient(s) | Result |

|---|---|---|---|---|

| Academy Awards[8] | February 27, 2011 | Best Documentary Feature | Charles H. Ferguson and Audrey Marrs | Won |

| Chicago Film Critics Association Awards[9] | December 20, 2010 | Best Documentary Feature | Nominated | |

| Gotham Independent Film Awards[10] | November 29, 2010 | Best Documentary | Nominated | |

| Las Vegas Film Critics Society Awards[11] | December 16, 2010 | Best Documentary Film | Nominated | |

| Online Film Critics Society Awards[12] | January 3, 2011 | Best Documentary | Nominated | |

| Phoenix Film Critics Society Awards[13] | December 28, 2010 | Best Documentary Feature | Nominated | |

| Writers Guild of America Awards[14] | February 5, 2011 | Best Documentary Screenplay | Won | |

| Directors Guild of America Awards[15] | December 29, 2010 | Best Documentary | Won |

[edit] See also

[edit] References

- ^ Adam Lashinsky interviews Charles Ferguson regarding 'Inside Job' at the Commonwealth Club (March 2, 2011). Retrieved on March 22, 2011.

- ^ http://movies.yahoo.com/news/movies.ap.org/list-83rd-annual-oscar-winners-ap

- ^ "Charlie Rose Interviews Charles Ferguson on his documentary 'Inside Job'", February 25, 2011

- ^ "Inside Job Movie Reviews, Pictures". Rotten Tomatoes. http://www.rottentomatoes.com/m/inside_job_2010/. Retrieved January 26, 2011.

- ^ Hill, Logan (May 16, 2010). "Is Matt Damon's Narration of a Cannes Doc a Sign that Hollywood is Abandoning Obama?". [[New York (magazine)|]]. http://nymag.com/daily/entertainment/2010/05/is_matt_damons_narration_of_a.html?imw=Y&f=most-viewed-24h10. Retrieved May 16, 2010.

- ^ Dargis, Manohla (May 16, 2010). "At Cannes, the Economy Is On-Screen". http://www.nytimes.com/2010/05/17/movies/17cannes.html?ref=arts. Retrieved May 17, 2010.

- ^ Maley, Dennis (November 16, 2010). "Inside Job is a Masterful Look at What Happened in Financial Collapse". The Bradenton Times. http://www.thebradentontimes.com/news/2010/11/16/art_and_culture/review_inside_job_is_a_masterful_look_at_what_happened_in_financial_collapse/. Retrieved January 26, 2011.

- ^ "Nominees for the 83rd Academy Awards". Academy of Motion Picture Arts and Sciences. http://www.oscars.org/awards/academyawards/83/nominees.html. Retrieved January 26, 2011.

- ^ "Chicago Film Critics Awards - 2008-2010". Chicago Film Critics Association. http://www.chicagofilmcritics.org/index.php?option=com_content&view=article&id=62&Itemid=60. Retrieved January 26, 2010.

- ^ Adams, Ryan (October 18, 2010). "2010 Gotham Independent Film Award Nominations". awardsdaily.com. http://www.awardsdaily.com/2010/10/gotham-nominations-live-stream/. Retrieved January 26, 2011.

Adams, Ryan (November 29, 2010). "20th Anniversary Gotham Independent Award winners". awardsdaily.com. http://www.awardsdaily.com/2010/11/20th-anniversary-gotham-independent-awards-live-stream/. Retrieved January 26, 2011. - ^ Adams, Ryan (December 16, 2010). "The Las Vegas Film Critics Society Awards". awardsdaily.com. http://www.awardsdaily.com/2010/12/the-las-vegas-film-critics-society/. Retrieved January 26, 2011.

- ^ Stone, Sarah (December 27, 2010). "Online Film Critics Society Nominations". awardsdaily.com. http://www.awardsdaily.com/2010/12/online-film-critics-society-nominations/. Retrieved January 26, 2011.

Stone, Sarah (January 3, 2011). "The Social Network Named Best Film by the Online Film Critics". awardsdaily.com. http://www.awardsdaily.com/2011/01/the-social-network-named-best-film-by-the-online-film-critics/. Retrieved January 26, 2011. - ^ "Phoenix Film Critics Name THE KINGS SPEECH Best Film of 2010". Phoenix Film Critics Society. http://phoenixfilmcriticssociety.org/annual-awards. Retrieved January 26, 2011.

- ^ "Writer's Guild of America 2011 Nominations". Writers Guild of America. http://www.wga.org/awards/awardssub.aspx?id=1516. Retrieved February 6, 2011.

- ^ "DGA 2011 Award Winners Announced". The Hollywood Reporter. http://www.hollywoodreporter.com/news/dga-2011-award-winners-announced-94341. Retrieved January 29, 2011.

- Official website

- Inside Job at the Internet Movie Database

- IONCINEMA.com TIFF 2010 Viral: Charles Ferguson's Inside Job

- [1] Radio interview for 'It's The Economy' with Claudia Cragg KGNU

AND SEE: MICHAEL MOORE'S FILM Capitalism: A Love Story | ||

BOOKS

Chang, H-Joon. 23 Things they Don’t Tell You About Capitalism. Bloomsbury , 2011. Rev. The Progressive (April 1011) by Amitabh Pal. “Chang is crystal clear about the calamitous effects of neoliberal economics on our planet.”

No comments:

Post a Comment